The Most Anticipated Airdrops of 2024

There's a good possibility that you have occasionally heard the term "airdrops," regardless of how experienced you are with DeFi.

This is due to the fact that airdrops are a well-liked marketing tactic for cryptocurrency and DeFi protocols for a number of reasons:

Some of the most popular cryptocurrency airdrops for 2024 are included in the guide below, including those that are probable, verified, and even recently distributed. You will quickly discover that in order to be eligible for them, you must, among other things, actively participate in the features of each protocol, communicate with their testnets, create new wallets, and invite friends to use the protocol. invite friends to use the protocol.

This is due to the fact that airdrops are a well-liked marketing tactic for cryptocurrency and DeFi protocols for a number of reasons:

- It makes it possible for protocols to give their community members rewards for their participation and activity on their particular platforms, which further encourages users to stick with the protocol.

- It supports projects that are promoting their native token and raising awareness of the brand, product, or service.

Some of the most popular cryptocurrency airdrops for 2024 are included in the guide below, including those that are probable, verified, and even recently distributed. You will quickly discover that in order to be eligible for them, you must, among other things, actively participate in the features of each protocol, communicate with their testnets, create new wallets, and invite friends to use the protocol. invite friends to use the protocol.

Keep in mind that any airdrop or token launch is just hypothetical and not guaranteed unless verified by the relevant protocol.

Jupiter

On the Solana blockchain, Jupiter is a prominent liquidity aggregator with more than 1.2 million users regularly trading and swapping assets on the network. On Solana, it manages roughly 60% to 70% of the total DEX volume.

Before the founding team announced their intention to introduce the protocol's native token, JUP, along with an official airdrop on January 31, Jupiter remained tokenless.

Since the airdrop was successful, JUP has risen to the top 100 cryptocurrencies in terms of market capitalization.

How did it function?

Before the founding team announced their intention to introduce the protocol's native token, JUP, along with an official airdrop on January 31, Jupiter remained tokenless.

Since the airdrop was successful, JUP has risen to the top 100 cryptocurrencies in terms of market capitalization.

How did it function?

- Through airdrops, the community will receive about 40% of the 10 billion JUP tokens that are available.

- Four airdrop rounds will be used to disperse the tokens, the first of which took place on January 31. We'll reveal any further dates.

- The Jupiter team will own 20% of the tokens, with the remaining half going to the community.

- The distribution of tokens is determined by a user's prior interaction with the platform, taking into account things like trade volume.

- The Jupiter DAO will be governed by the JUP token in the future.

- It is predicted that revenue sharing for the JUP token will not take place until Jupiter's user base has increased tenfold, which will take two years.

This implies that you remain eligible for the airdrop in subsequent rounds. Here's how to do it:

- Go to the Jupiter website and attach your wallet from Solana.

- Select from a variety of Jupiter activities, including Swaps.

- Additionally, you can use their bridge tool to do cross-chain operations or browse their section on perpetual trading.

LayerZero

With LayerZero, numerous blockchains are connected via an Ethereum-based interoperability protocol that enables dApps to communicate with many networks using a single relayer. For instance, LayerZero's messaging system is used by the liquidity transfer protocol Stargate to facilitate cross-chain transfers.

Crypto aficionados are certain that an airdrop will accompany the launching of the token, even though the exact parameters are still unknown. Others claim that the token will provide users governance rights, allowing them to decide LayerZero's development, much like earlier Ethereum ecosystem ventures.

How to be eligible:

How to be eligible:

- Interacting with protocols that have integrated LayerZero is the objective here.

- Among the well-liked choices are Pendle, Stargate, Curve, and Shrapnel.

- One way to earn passive revenue is by staking STG tokens on Stargate, providing liquidity, or participating actively in the DAO community.

Marginfi

Although there is currently no token for the decentralized lending protocol Marginfi, there have been rumors of a token launch in the future. Both lenders and borrowers gain from the increased risk management that the protocol provides in lending services.

Airdrop hunters are persuaded that Marginfi is not planning to release a token, despite the fact that the protocol uses a points system and has the support of multiple investors and venture capitalists.

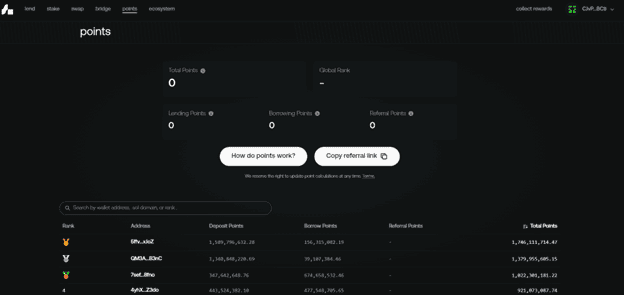

Users can earn points through lending, borrowing, and referrals, among other activities, which may qualify them for an airdrop.

The qualification procedure could look something like this, step by step:

The qualification procedure could look something like this, step by step:

- Open a Solana wallet and go to the Marginfi website.

- Bridging, trading, and staking assets will make you more eligible.

- Nonetheless, the best methods to accrue "mrgn points" are by lending, borrowing, and referring.

- Points are earned by users with active deposits (1 point per day for every dollar lent). Longer length and more lending equal more points.

- More points are awarded to borrowers than to lenders (4 points per day for every $1 borrowed).

- Lending points are also awarded for collateral used in loans.

- As additional people refer others, referral users continue to earn 10%, which goes down the referral tree.

EigenLayer

In the crypto community, EigenLayer, an Ethereum-based liquid staking mechanism, has drawn a lot of interest, particularly from airdrop seekers.

A component of EigenLayer is called restaking, which enables Ethereum token owners to restake their currencies on different Ethereum-based protocols. By employing the restaked tokens, a strong blockchain ecosystem with pooled security is created.

A component of EigenLayer is called restaking, which enables Ethereum token owners to restake their currencies on different Ethereum-based protocols. By employing the restaked tokens, a strong blockchain ecosystem with pooled security is created.

A number of cutting-edge capabilities like yield farming and staking have been included by the protocol. Due to the volume of ongoing development and the points system that pays out to depositors, airdrop enthusiasts are eagerly awaiting a possible token drop. That is, in addition to EigenLayer's roadmap, which indicates that the company plans to introduce payment and cutting systems in Q3 of 2024 when the mainnet launches.

In the event of a future airdrop, how to be eligible:

In the event of a future airdrop, how to be eligible:

- Open the app, then link your wallet.

- Pick from any of the pools that are accessible.

- Put rETH or sETH at riskPut rETH or sETH at risk

- Repeat this often to improve your chances of being accepted.

Base

For on-chain applications, Coinbase's Base Ethereum Layer 2 (L2) chain, created in partnership with Optimism, provides a safe, affordable, and developer-friendly environment.

Though it's not totally ruled out, there have been rumors of an airdrop, mostly because Coinbase's Chief Legal Officer has alluded to the prospect of a future token launch.

It should come as no surprise that this comment set off a chain of rumors, alerting Base users and airdrop producers to the possibility of an airdrop at any point in 2024.

If early users regularly interact on the ecosystem through reliable protocols like the Rhino, they might be qualified for an airdrop.fi bridge and trade on exchanges like as Odos and Uniswap. These are but a handful of the most widely used apps on Base.

It should come as no surprise that this comment set off a chain of rumors, alerting Base users and airdrop producers to the possibility of an airdrop at any point in 2024.

If early users regularly interact on the ecosystem through reliable protocols like the Rhino, they might be qualified for an airdrop.fi bridge and trade on exchanges like as Odos and Uniswap. These are but a handful of the most widely used apps on Base.

Risks & Security Practices to Consider Before Hunting Airdrops

In the cryptocurrency space, airdrops are getting more and more popular, but along with that growth comes an increase in the threats that could jeopardize our financial standing and even sound data.

- Wallets: When taking part in airdrops, having a cryptocurrency wallet is essential. Use a wallet with a strong algorithm to produce random seed phrases that are difficult for hackers to decipher in the end.

- Tax Liability: In the US and several other countries, airdrops are subject to taxes.

- Potential scams: not all airdrops are worthwhile, and some can be connected to dubious or subpar initiatives.

- DYOR: Please investigate a project thoroughly, double-check URLs, click on the correct links, don't sign anything unless you are certain of its legality, and proceed with caution if you plan to participate in airdrops.

- Market Volatility: erratic price swings in airdrop tokens might be brought on by market volatility.